First published on Thomson Reuters Regulatory Intelligence on 20th July 2023.

Getting ready for Unique Product Identifiers: what firms can do now

By Emma Kalliomaki, Managing Director, ANNA and the DSB

2024 marks the start of reporting requirements for the Unique Product Identifier, UPI, in five leading derivatives jurisdictions, a major milestone for this important G20 initiative. The UPI has been designed to facilitate regulators’ understanding of systemic risks in OTC derivatives on a global basis, following the 2007-08 financial crisis. Consequently, 2023 is the year the industry needs to prepare for the launch of the UPI, especially those firms which operate across multiple jurisdictions and will have differing regulatory reporting requirements starting on different dates.

The Derivatives Service Bureau, DSB, designated by the Financial Stability Board as the sole service provider for the UPI, issues the UPI codes as well as operating the UPI reference data library. In this article I cover the UPI mandates announced to date, the preparatory actions firms need to take and what the DSB is doing to assist industry make these preparations.

Fast Approaching Regulatory Deadlines

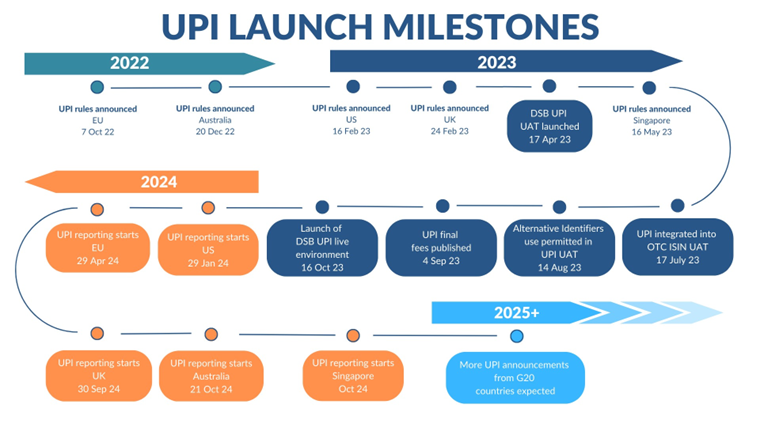

Over the last twelve months the EU, UK, US, Australia and Singapore have published their rules to enforce UPI requirements. The EU made the first announcement, in October 2022, that the UPI would be reported as part of the EMIR Refit regulations from 29 April 2024. The UK has subsequently confirmed it will mandate the use of UPI from 30 September 2024, also under the UK EMIR Refit framework.

Whilst the EU fired the starting pistol, the US will be the first jurisdiction to actually go live with the UPI from 29 January 2024 for swap record keeping and reporting. Australia and Singapore have also announced UPI reporting will commence in their jurisdictions in October 2024. Japan too has published its reporting rules, with the compliance start date for the UPI pending confirmation.

More G20 jurisdictions are expected to announce their UPI rules in the coming months and the DSB is publishing links to consultations and rules on its website as they arise to assist industry navigate the different mandates.

DSB Industry Support

So with regulatory deadlines fast approaching, what steps should firms take?

Market participants need to review their workflows to understand how they will report the UPI to Trade Repositories, directly or otherwise. Participants will therefore need to obtain UPIs, and subsequently integrate the codes and the associated UPI reference data record into their internal and regulatory reporting workflows. The DSB’s UPI Service User Acceptance Testing, UAT, environment, which opened on 17 April 2023, allows prospective users to test connectivity and access options free of charge for 6 months from the date of entering it. The DSB encourages stakeholders to onboard and maximise the testing time available before their first reporting deadline falls due.

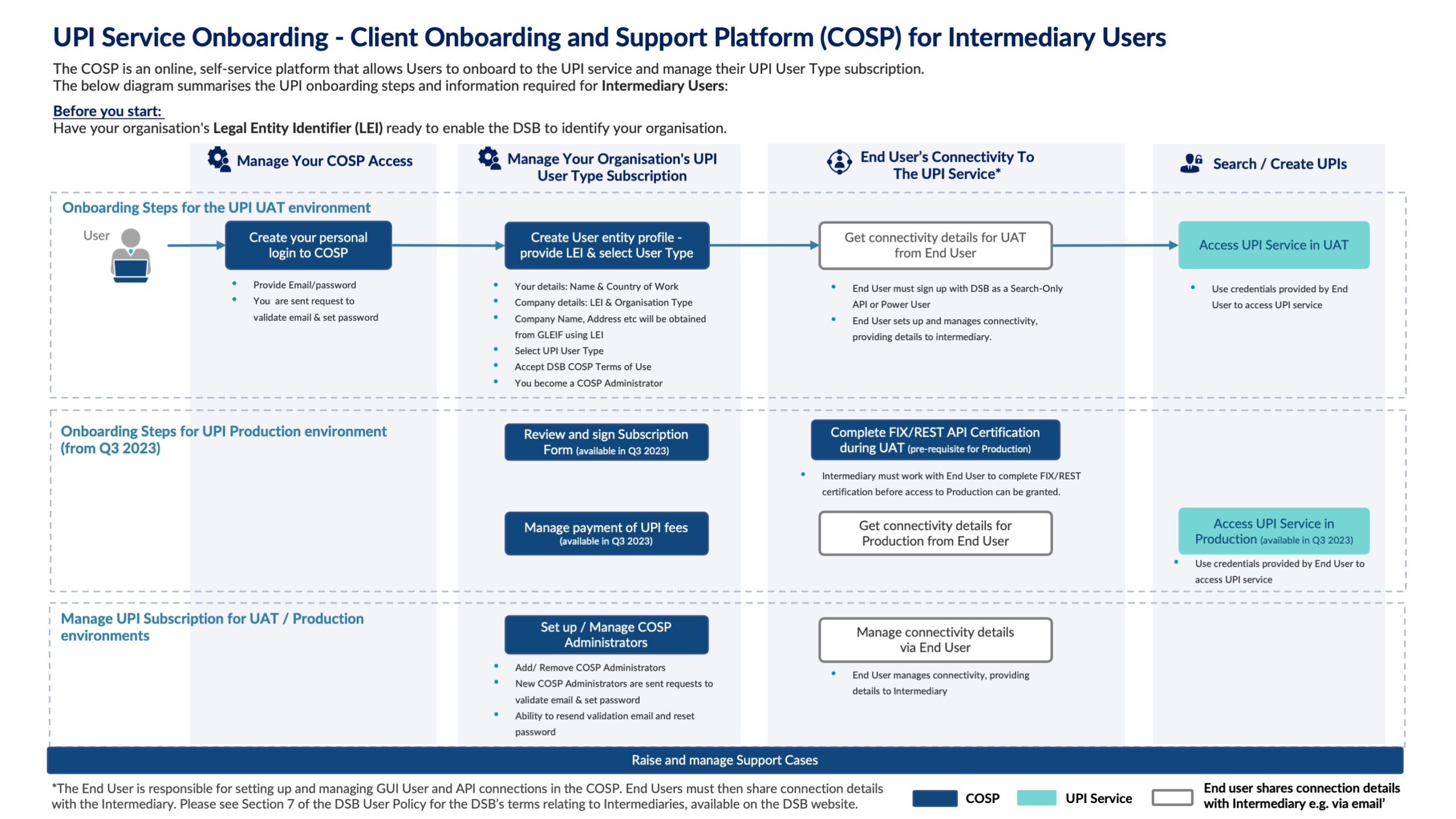

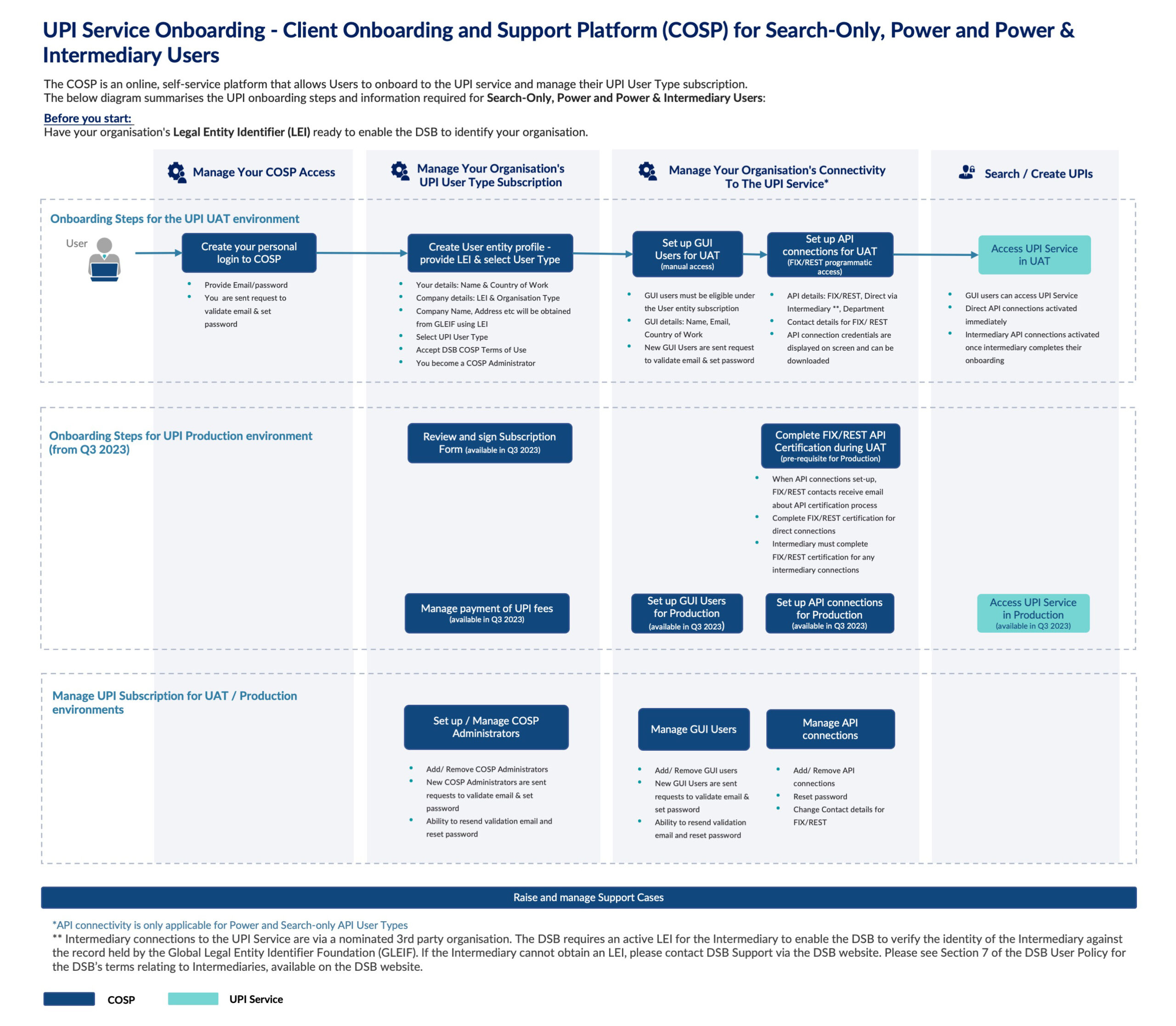

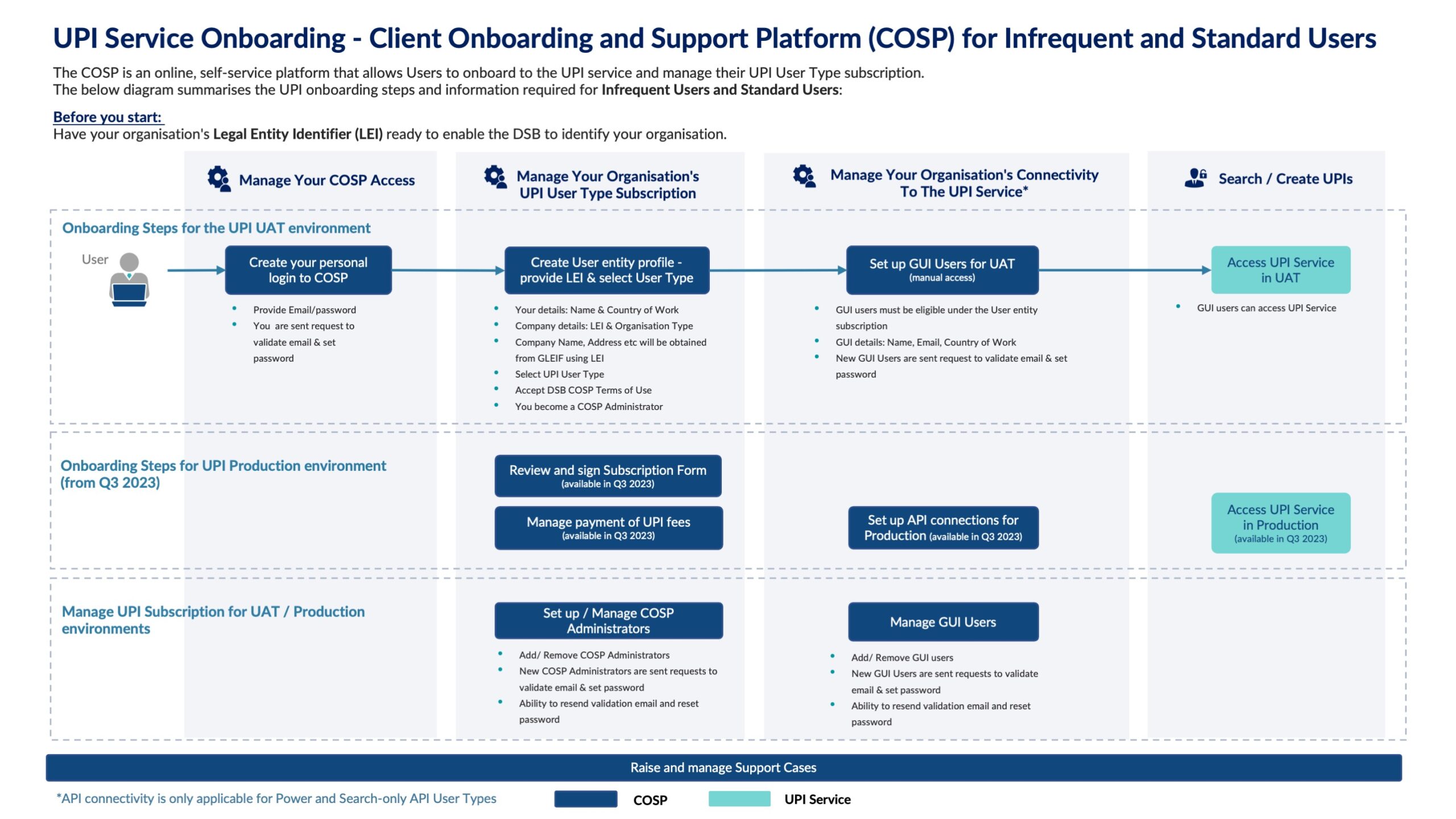

At the same time as launching the UAT, the DSB opened its Client Onboarding and Support Platform, COSP. The COSP is an online, self-service platform which allows users to manage their UPI subscriptions and connectivity options to search for and/or create UPIs. The DSB offers five main user types; two programmatic connectivity types, two manual connectivity types and the free Registered User option which allows firms to search the web-interface in real time for UPIs and download UPI files on a T+1 basis. Firms can test these different options in UAT, onboarding via the COSP , to determine which user type is most suited to their needs. The DSB will publish final fees for UPI use in September 2023.

The DSB Production environment will launch on 16 October 2023, three months before the first UPI compliance go live date, at which point users of the UPI Service will be able to create new UPIs in readiness for their reporting obligations.

The OTC ISIN and the Need for Complementary Standards

The UPI (ISO 4914) is part of the ISO framework which, together with the Classification of Financial Instruments, CFI, (ISO 10962) and OTC International Securities Identification Numbers, ISINs, (ISO 6166), form an identification hierarchy for OTC derivatives. The DSB issues the CFI, UPI and OTC ISIN for OTC derivatives, ensuring that they remain complementary whilst serving different purposes. The CFI attributes are a subset of the UPI attributes, and the UPI attributes are a subset of the OTC ISIN attributes. Put another way, an OTC ISIN will have only one UPI ‘parent’, but a UPI may have none, one or many OTC ISIN ‘children’.

In the EU and the UK, the OTC ISIN is used today for regulatory reporting purposes and has a role in the EU and UK EMIR Refit rules which, helpfully, are almost identical. Market participants will need to report either the UPI or the OTC ISIN to a Trade Repository depending, broadly speaking, on where the derivative or its underlier is traded. An important question for existing OTC ISIN users, therefore, is when they can start testing combined UPI and OTC ISIN data in UAT. The DSB opened the UAT environment for combined UPI and OTC ISIN data on 17 July 2023, 9 months before the EU’s mandate comes into effect.

To support users’ UPI integration, the DSB will also perform a ‘pre-population’ exercise, to attach the relevant ‘parent’ UPI code to existing OTC ISIN records, when the Production Environment is launched in October 2023. Consequently, some firms may be able to meet their UPI requirements through their existing OTC ISIN Service. However, it’s important to note that in such cases, firms will still be required to obtain an equivalent UPI agreement and contribute to the UPI cost recovery model through paying the appropriate UPI Service fee. This is linked to the principles of the DSB as an industry utility, operating on a cost recovery basis, with the UPI and OTC ISIN Services having separate cost recovery fee models. The principle is to ensure that the cost of each service is shared fairly among all users, irrespective of how they access the data.

This is the beginning, not the end

2024 is the starting point not the end: more G20 jurisdictions are expected to announce their UPI rules as part of the global drive to improve harmonisation and transparency into the OTC derivatives market. UPI implementation will help achieve these goals through standardisation and enhanced data quality. The DSB is proud to launch the UPI UAT Service as scheduled to help all stakeholders prepare for the upcoming regulatory requirements. UPI Product Templates, and a UPI User Guide and FAQ are readily available on the DSB website. Please follow the link: https://www-staging.anna-dsb.net/upi/