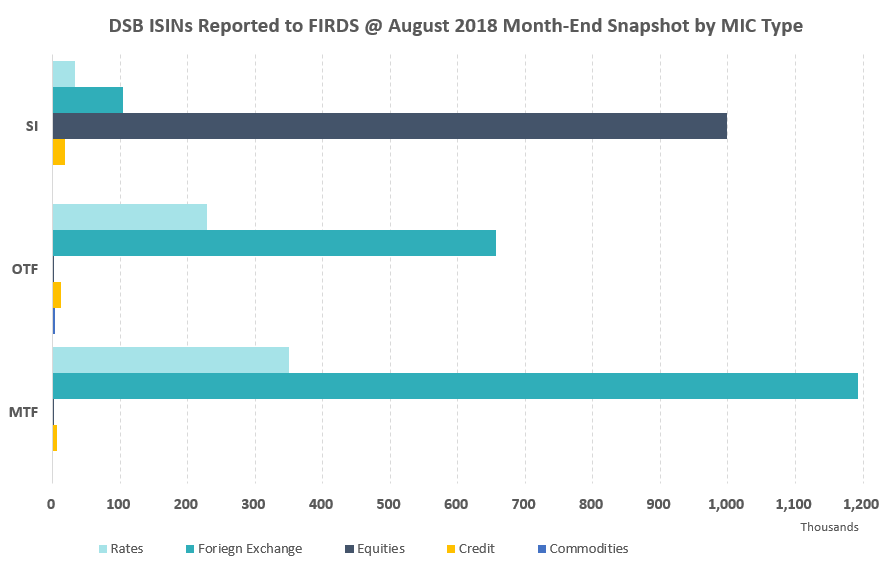

Analysis of the FIRDS snapshot for August month-end showed little material change vs. the prior month.

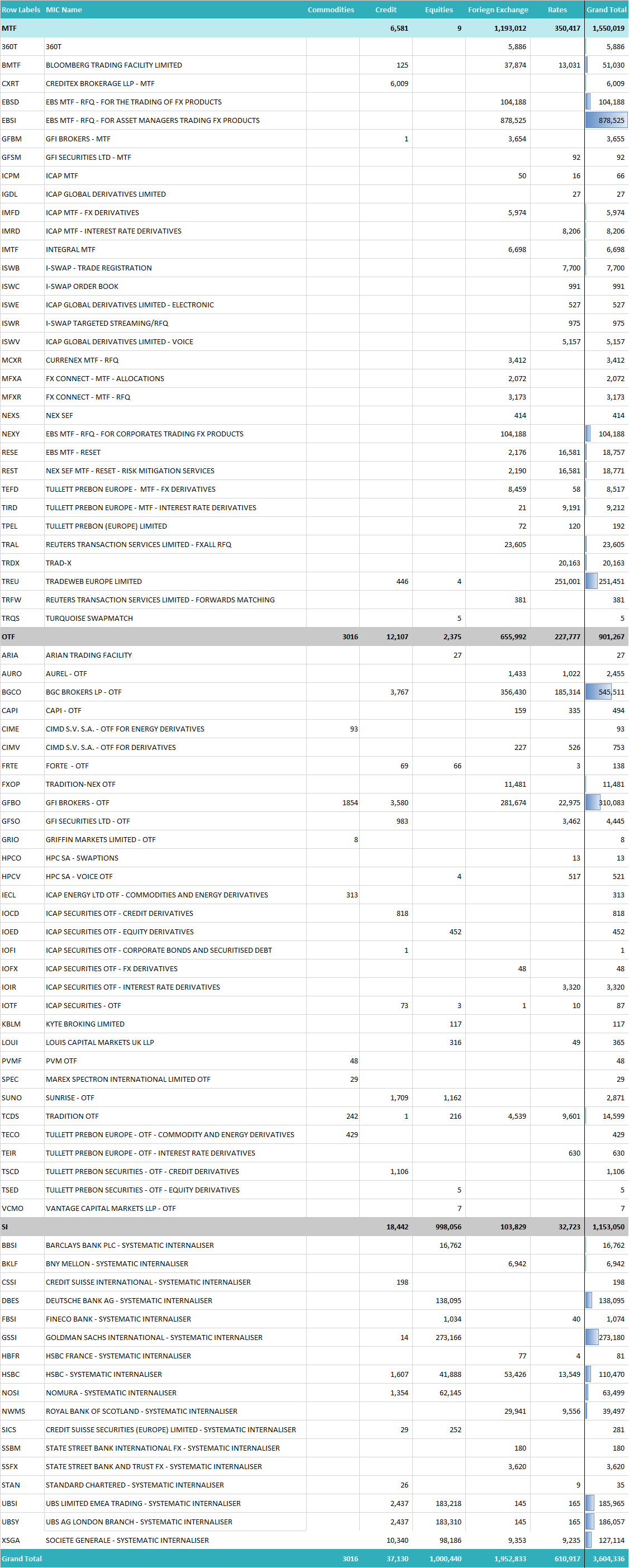

Systematic Internalisers, MTFs and OTFs continued to report similar proportions of OTC ISINs for each asset class, with SIs dominating equities reference data reporting and the venues more focused on FX and Rates reference data reporting as set out below.

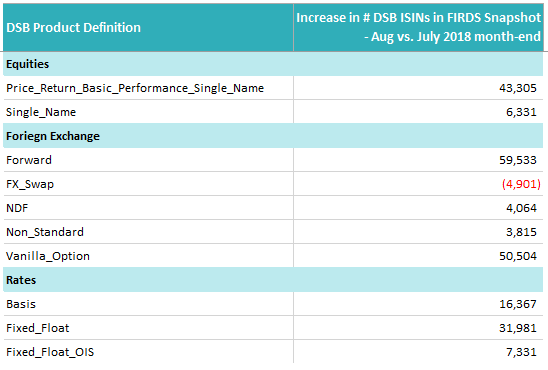

Unsurprisingly, the largest increase in the reporting of reference data was seen in Equities, FX and Rates – with a slight change in the product mix vs. last month end. The August snapshot shows a slight decrease in the number of FX Swaps reported, accompanied by similar increases in the number of FX Swaps and Non-Standard FX Forwards and Non-Standard FX Options reported to FIRDS.

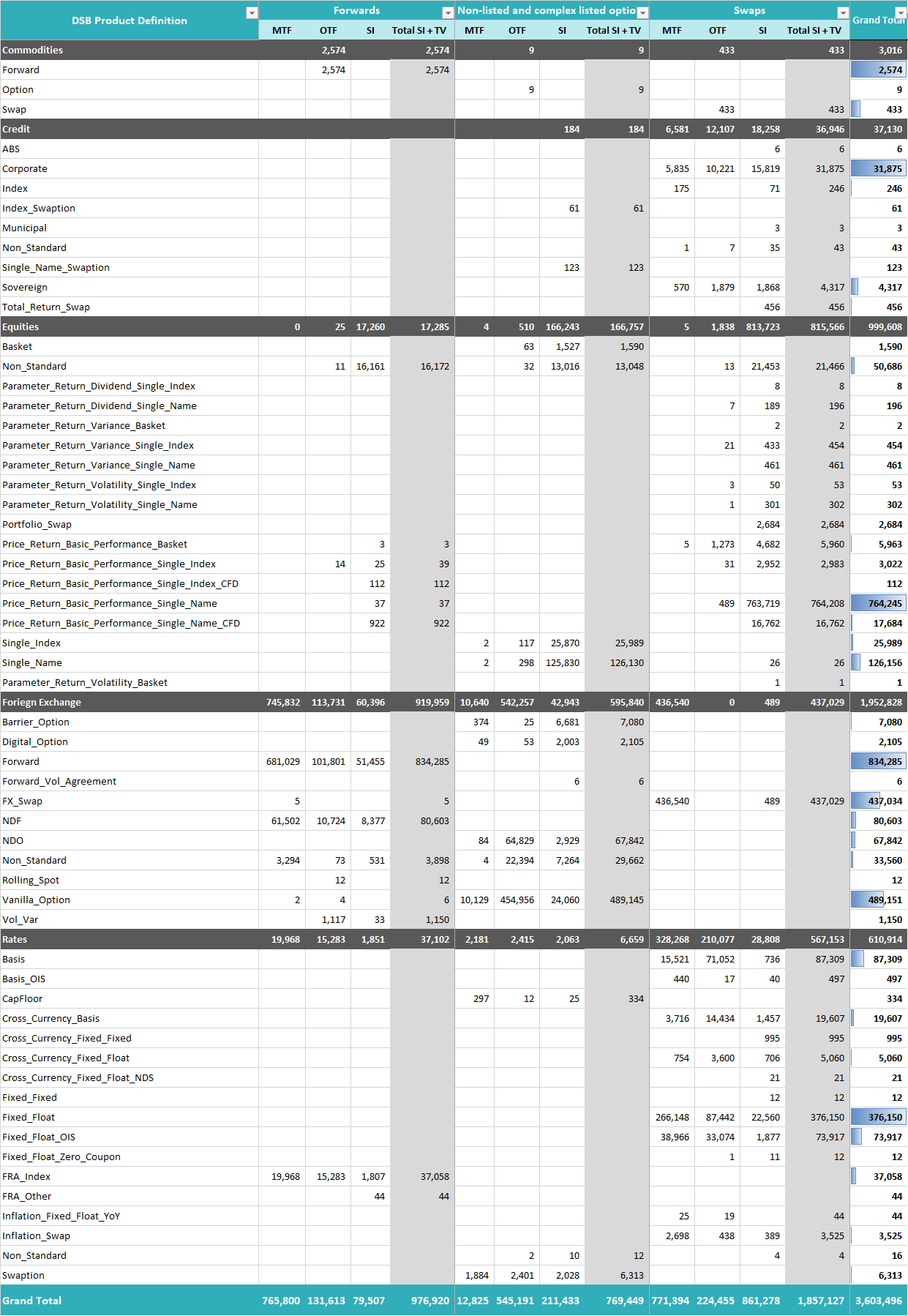

As with prior months, there is little reference data reporting for commodities in general, with OTFs continuing to dominate this arena. A detailed breakdown for every DSB product reported to FIRDS (for reference data purposes) is set out below.

The list of MICs reporting to FIRDS was largely consistent, with only one less OTF reporting to FIRDS in August than in July 2018. The usual MIC level analysis is set out below.

Published by Malavika Solanki